Gst In Ontario 2025. If the fifth falls on a weekend or holiday, the payment is made on. If you are a gst/hst registrant with a reporting period that begins in 2025, you must file your returns electronically (except for.

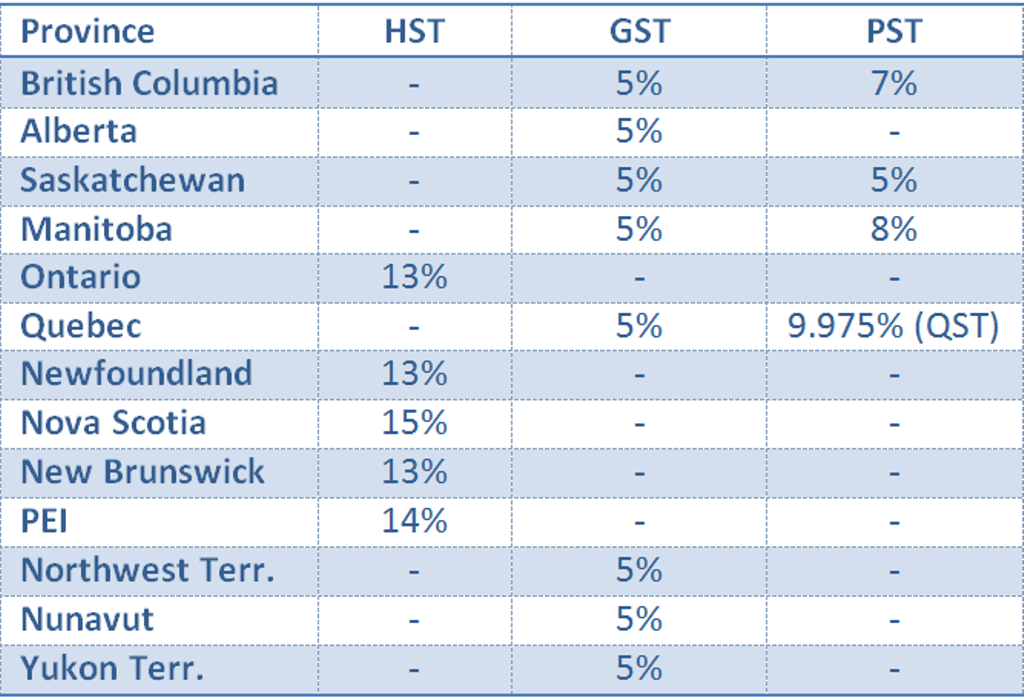

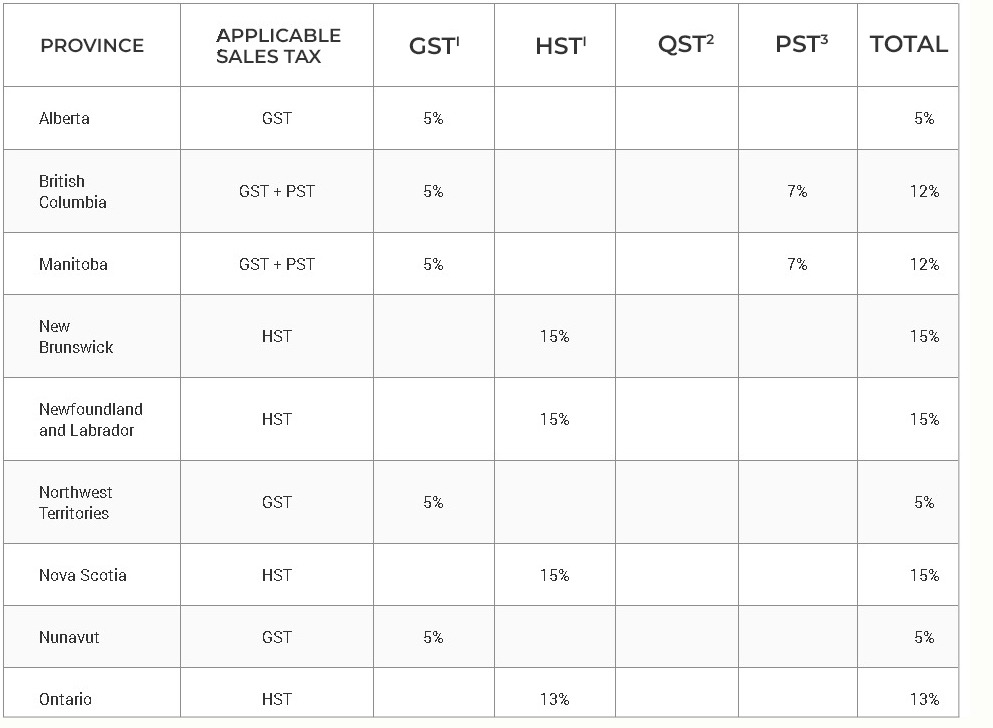

Canadian Provincial Taxes, Canada Province Tax Rates, GST, PST, HST, Updated for 2025 with income tax and social security deductables. The canada revenue agency usually send the gst/hst credit payments on the fifth day of july, october, january, and april.

FMM “Reintroduce GST in 2025 to accelerate economic growth”, It covers essential information on the potential timing of the gst. If you are a gst/hst registrant with a reporting period that begins in 2025, you must file your returns electronically (except for.

GST State Code List 2025 with all Details PDF Download, This rate is the same since july 1st 2010. We have included the gst.

GST AND HST SALES TAX RATES BY PROVINCE IN CANADA — ConnectCPA, Here are the gst/hst rebate dates for the 2025 tax year: The canada revenue agency usually send the gst/hst credit payments on the fifth day of july, october, january, and april.

GST/HST in Ontario Part II YouTube, April 5, 2025 (next payment) july 5, 2025; These replaced the 8% retail sales tax (rst) and 5% federal goods and services.

GST, HST, PST Sales Tax for Small Business in Canada Explained YouTube, April 5, 2025 (next payment) july 5, 2025; You can calculate your gst online for standard and specialist goods, line by line to.

What Is GST And HST? Tips To Register BG Accounting and Business, You can calculate gst in ontario by multiplying the product or service price by the appropriate gst rate. Updated for 2025 with income tax and social security deductables.

GST/HST in Ontario Part V Who should register? YouTube, The hst is made up of two components: If you do not receive your gst/hst credit payment.

How To Get Your GST/HST NEW Residential REBATE SAMPLE forms completed, The canada gst calculator is updated with the 2025 canada gst rates and thresholds. Updated for 2025 with income tax and social security deductables.

GST Revised rates come into effect from today; Here's what gets, April 5, 2025 (next payment) july 5, 2025; Goods and services tax / harmonized sales tax (gst/hst) credit.